There’s more to life than just making money

By Vijay Badhwar

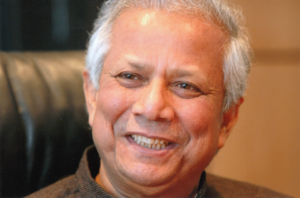

Noble Laureate Muhammad Yunus provided a stark contrast between his concept of banking and the Australia’s Big Four, the former full of joy and satisfaction and the latter with lots of disgruntled customers.

It was truly an inspirational lecture at the University of New South Wales on November 4 that life was much more than just making money being ”˜wealth robots’, in Prof Yunus’ language. Teaching at the university with beautiful surroundings was living but not fulfilling as he wanted to do more to make a difference. The slums just outside the university provided this opportunity to do something for fellow human beings that were left out at the lowest rungs of the society, he said.

Bangladesh is a flat land mass just one metre above sea level, hence a country under constant threat from global warming. It is so crowded, Prof Yunus said, that if the whole world population of 7.7 billion people moved into America, its density will still be lesser than Bangladesh’s. With no mineral or oil resources, its people keep moving northwards threatened by rising sea levels.

Prof Yunus said he started to lend to a few poor people in the neighbouring villages, also urging them to start a business, especially to women who were the most downtrodden. The women made the most difference as the power centre in the family shifted.

As the concept grew, we had to have rules, some structure, he said. “But that wasn’t a problem as we had the business models of plethora of lending institutions right in front of us. What we had to do was the exact opposite ”“ lending to poor people rather than the rich, people with no assets than the asset rich, women than the men as nobody lent it to them.”

It worked. The concept of micro credit was a runaway success in Bangladesh as the next generation of borrowers were also educated. We kept pressing on them that they should come up with business ideas which they were at loss with in the beginning. “Just ask your mother to give you an idea if you have none,” he said.

The Grameen Bank Prof Yunus established in 1983 empowered women who were nearly 97 per cent of its clients. This has made some enemies in the Islamic world for Prof Yunus. At the Q&A programme on the night before the talk at the UNSW, Prof Yunus sidestepped the issue of extremism but commented against amendments to Section 18C on the ground that free speech should also carry responsibility.

Short URL: https://indiandownunder.com.au/?p=8651