Home-coming for Air India

By Ashok Malik & Vijay Badhwar

Air India is back to its creator Tatas, an emotional reunion that the Group could not let go, its fate on tenterhooks with no other bidders forthcoming and the Indian Government even considering to shut down the national carrier.

The Tata Group’s bid of Rs18,000 crore (nearly eight billion dollars) was accepted by the Government, Rs 2700 crore in cash and the rest to service the burgeoning debt the airline has heaped on itself due to its inefficiencies, especially after 2007 when it was merged with Indian Airlines for, ironically, a contrary outcome. The successful bidder is Talace Private, a wholly owned subsidiary of Tata Sons who operate Vistara Airlines and Air Asia India.

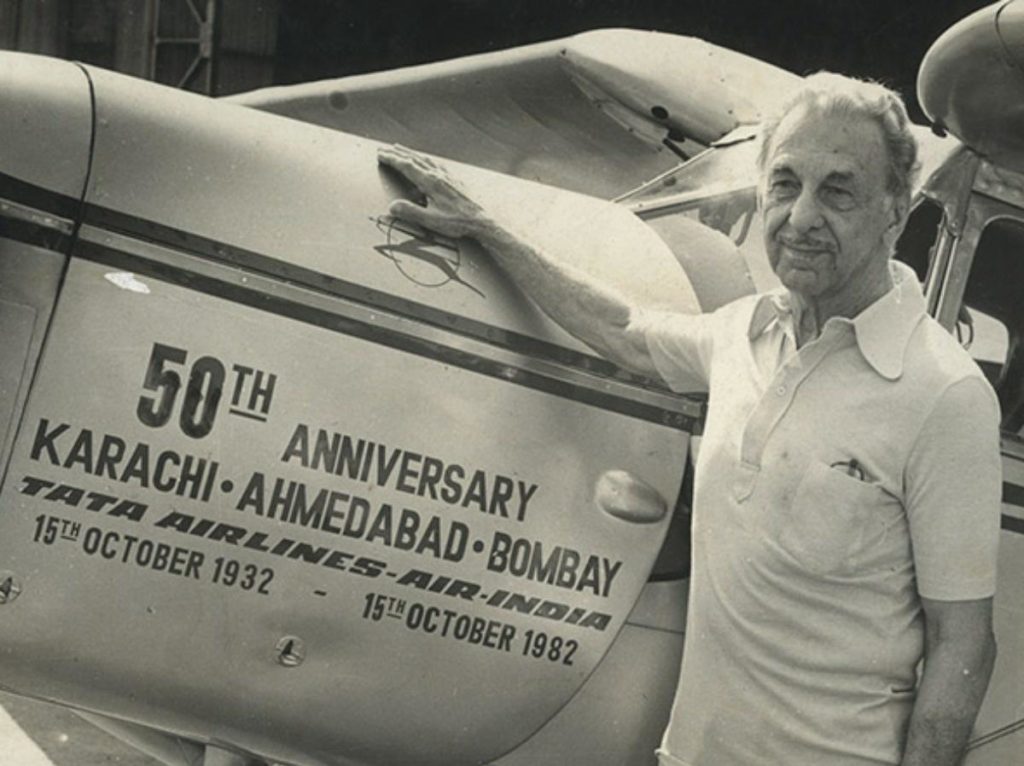

JRD Tata founded Air India in 1932 which was, at one time, reckoned among the most prestigious airlines in the world. With India gaining independence from the British, in 1947, 49 per cent stake was bought by the government. The 100 per cent takeover by the government was completed in 1953 and Air India was nationalised.

This marked the beginning of inefficiencies, bureaucratic red-tape and ministerial interferences as the airline schedules were juggled to accommodate ministerial whims. There were allegedly large-scale scandals in lease and purchase arrangements of aircraft and services: at one time in 2004, UPA minister Praful Patel inflated the order to purchase 68 Boeing aircraft from originally planned 28 despite the department’s advice on the contrary. This cost the government Rs 50,000 crore and the excess aircraft stood idle on the tarmac in Mumbai for more than a year.

Air India has been a hard sell with a debt of nearly Rs 61,500 crore and rising each day by approximately Rs 20 crore largely due to servicing of debt and its overgenerous staff and conditions. In 2012, its employee to aircraft ratio of 221(currently reduced to 95) was the highest in the world. No wonder, after several attempts to offload the carrier, a single joint offer by Tata Group and Singapore Airlines in 2001 was withdrawn at the last minute.

The Government, in its earlier offers, wanted to keep a part stake in the airline – 60 per cent in 2001 and 24 per cent in 2018 – a deal no one seemed to be interested in as they feared government interference in managing the airline. This time, however, the government let the bidders decide how much debt they were willing to pick up.

In the successful deal, the Indian Government will keep all the building assets which should generate nearly a quarter of the funds needed to service the debt. The Government will also clear 1332 crores owed to its employees. Tata Sons shall retain all of 13,000 employees – 9000 permanent, and the rest in deputation from other departments and on contract – for a minimum period of one year. After, they may offer redundancies or wait on natural attrition estimated to be 1000 employees a year. Tatas will also look after medical and other benefits now available to the airline staff.

The new owner will enjoy benefits such as huge international and domestic slots for landings and take off, a large aircraft fleet in excess of 100 aircraft including a mixture of wide and narrow body aircraft.

Besides the huge debt the challenge for Tata sons will be to pay very high leasing rentals for numerous aircraft, majority of the fleet needing updating and refurbishment of cabins, and excess staff, also enjoying overgenerous benefits of free tickets for extensive travel compared to other airlines.

The deal will test Tatas’ resolve, especially to manage massive union reform. Although emotional decisions have an element of bias lacking logic, the decision-maker Ratan Tata saw an opportunity for Tata Group’s presence in aviation industry: to regain the reputation and image enjoyed in its earlier years.

Short URL: https://indiandownunder.com.au/?p=16975